Business Insurance in and around Charlotte

Calling all small business owners of Charlotte!

This small business insurance is not risky

Help Protect Your Business With State Farm.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected damage or loss. And you also want to care for any staff and customers who stumble and fall on your property.

Calling all small business owners of Charlotte!

This small business insurance is not risky

Insurance Designed For Small Business

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like errors and omissions liability or business continuity plans, that can be formed to develop a personalized policy to fit your small business's needs. And when the unexpected does happen, agent Daniela Melendez can also help you file your claim.

So, take the responsible next step for your business and visit with State Farm agent Daniela Melendez to identify your small business insurance options!

Simple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

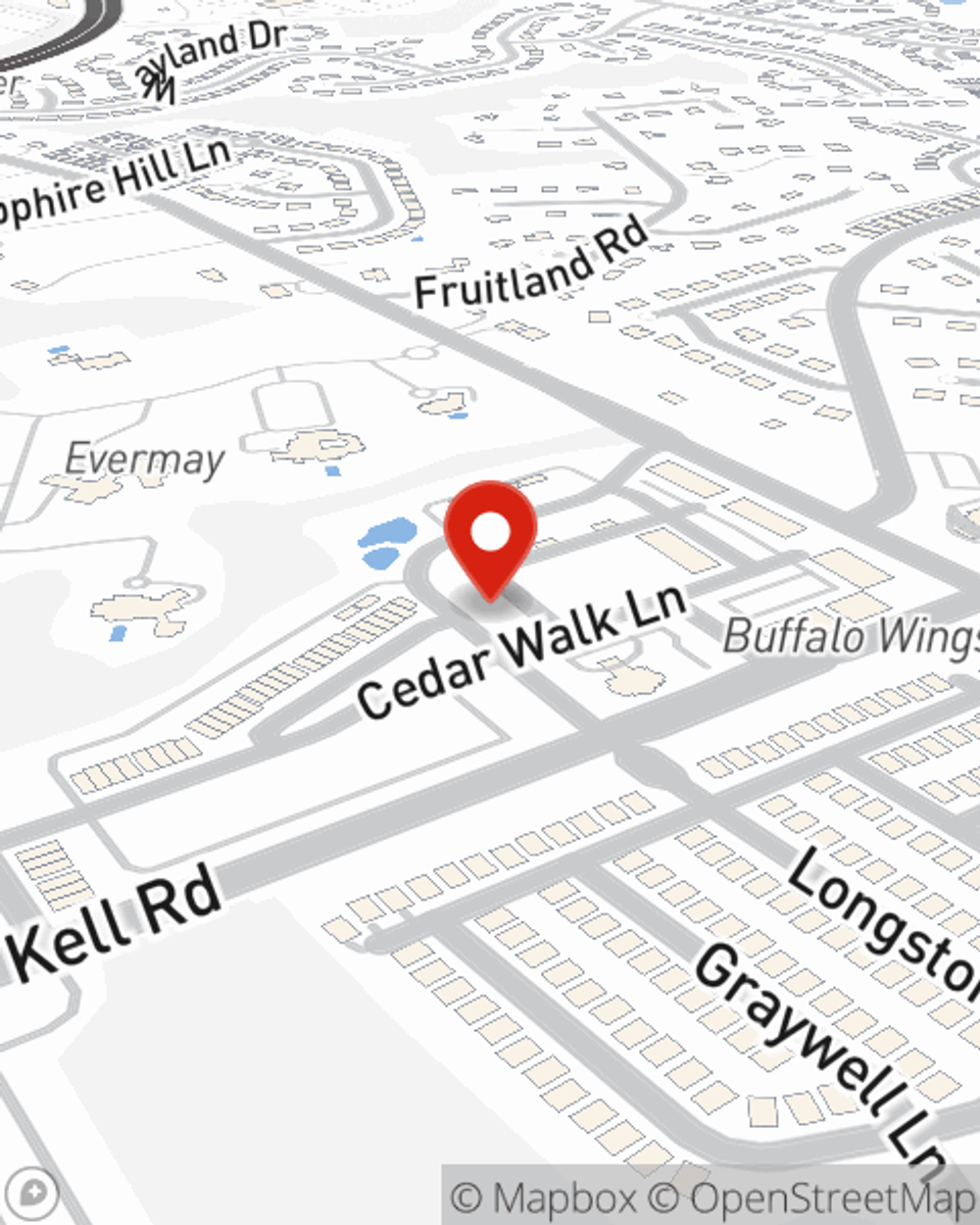

Daniela Melendez

State Farm® Insurance AgentSimple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.